|

“Nancy is an amazing agent!. She went “above and beyond” to help us find the perfect home. She took the time to show us many houses. She was patient while we decided. She worked with and for us every step of the way. I recommend her to anyone looking to buy here. We moved from Connecticut and she educated us on the area so we were comfortable moving somewhere we had never been before.” Duncan Brown - Murrells Inlet, SC |

Nancy Aborn Wuennemann |

|

11/7/2023 0 Comments Reasons to sell in 2023As 2023 down, you may have decided it's time to make a move and put your house on the market. But should you sell now or wait until January? While it may be tempting to hold off until after the holidays, here are three reasons to make your move before the crystal ball drops.

Get One Step Ahead of Other Sellers Typically, in the residential real estate market, homeowners are less likely to list their houses toward the end of the year. That’s because people get busy around the holidays and sometimes deprioritize selling their house until the start of the new year when their schedules and social calendars calm down. Selling now, while other homeowners may hold off until after the holidays, can help you get a leg up on your competition. Get Your House in Front of Eager Buyers Even though the supply of homes for sale did grow compared to last year, it’s still low. That means there aren’t enough homes on the market today. While some buyers may also delay their plans to move until January, others will still need to move for personal reasons or because something in their life has changed. Those buyers are still going to be active later this year and will be seriously motivated to make their move happen because they need to. Unfortunately, the challenge they'll face is a shortage of available inventory to meet their needs. A recent article from Investopedia says: “. . . if your house is up for sale in the winter and someone is looking at it, chances are that person is serious and ready to buy. Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer. Putting your home on the market at this time of year and attracting a serious buyer can often result in a quicker sale.” Use Your Equity to Fuel Your Move Keep in mind that homeowners today have record amounts of equity. According to CoreLogic, the average amount of equity per mortgage holder has climbed to almost $290,000. That means the equity you have in your house right now could cover some, if not all, of a down payment on the home of your dreams. And as you weigh the reasons to sell before year-end, it's important to remember the reasons that sparked your desire to move in the first place. Maybe it’s time for a new home in a location that suits you better, one that offers the perfect space for you and your loved ones, or maybe your needs have evolved over time. I can help you determine how much home equity you have and how you can use it to achieve your goal of making a move. My Bottom Line: Listing your home before 2024 marches in can offer unique benefits. Less competition, motivated CASH buyers, and your equity gains can all play to your advantage. Reach out, and let's achieve your goals before winter sets in.

0 Comments

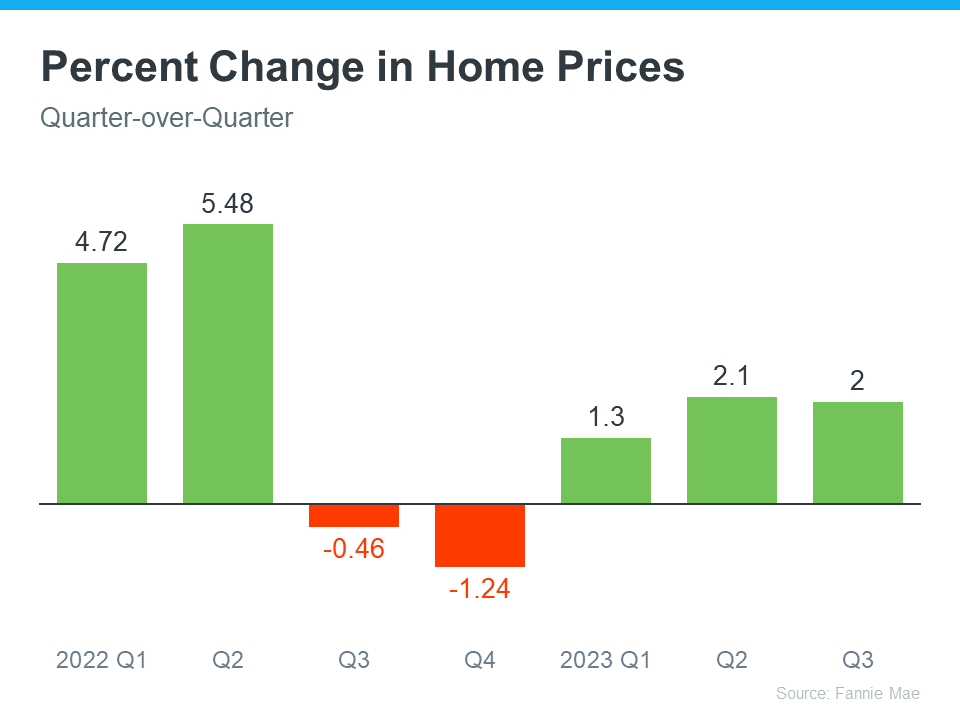

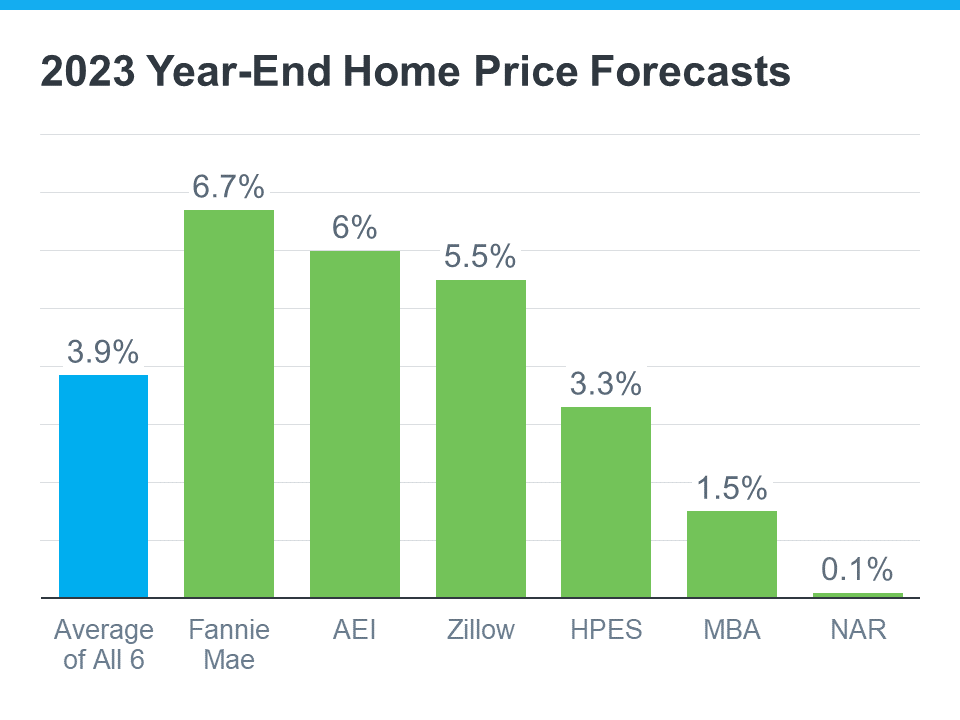

11/2/2023 0 Comments don't believe everything you hear!There’s been a lot of misleading information about home prices over the past year. And that’s still having an impact on how people are feeling about the housing market today. But it’s best not to believe everything you hear or read. According to the latest data from Fannie Mae, 23% of Americans still think home prices will go down over the next twelve months. But why do roughly 1 in 4 people feel that way? It has a lot to do with all the negative talk about home prices over the past year. Since late 2022, the media has created a lot of fear about a price crash and those concerns are still lingering. You may be hearing people in your own life saying they’re worried about home prices or see on social media that some influencers are saying prices are going to come tumbling down. If you’re someone who still thinks prices are going to fall, ask yourself this: Which is a more reliable place to get your information – clickbait headlines and social media or a trusted expert on the housing market? The answer is simple. Listen to the professionals who specialize in residential real estate. Here’s the latest data you can actually trust. Housing market experts acknowledge that nationally, prices did dip down slightly late last year, but that was short-lived. Data shows prices have already rebounded this year after that slight decline in 2022 (see graph below): But it’s not just Fannie Mae that’s reporting this bounce back. Experts from across the industry are showing it in their data too. And that’s why so many forecasts now project home prices will net positive this year – not negative. The graph below helps prove this point with the latest forecasts from each organization: What’s worth noting is that, just a few short weeks ago, the Fannie Mae forecast was for 3.9% appreciation in 2023.

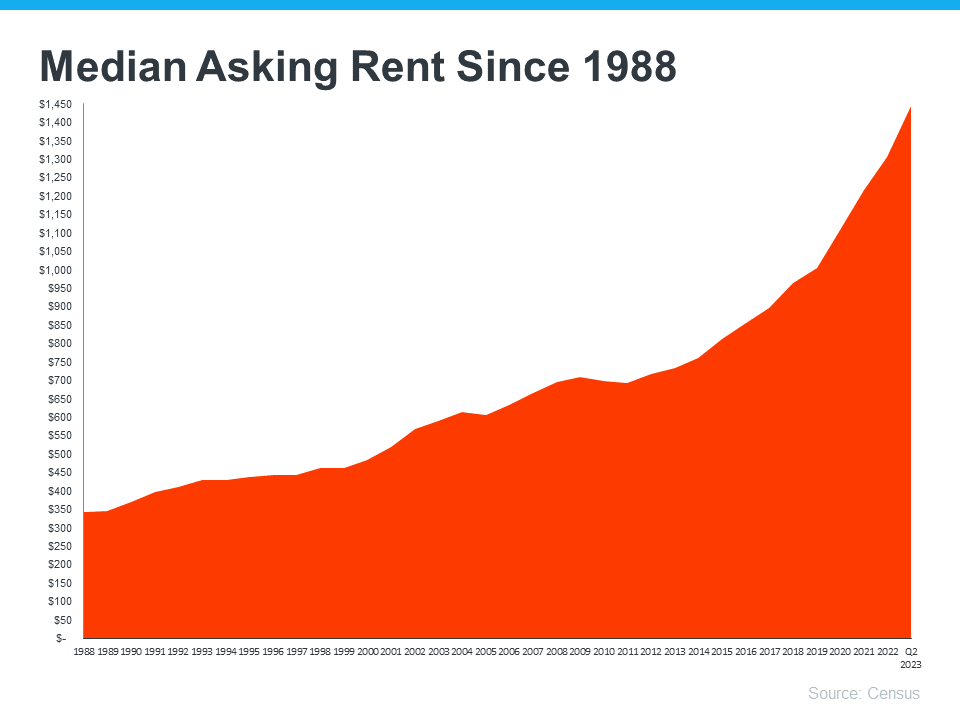

In the forecast that just came out, that projection was updated from 3.9% to 6.7% for the year. This increase goes to show just how confident experts are that home prices will net positive this year. So, if you believe home prices are falling, it may be time to get your insights from the experts instead – and they’re saying prices aren’t falling, they’re climbing! Are you a baby boomer who’s lived in your current house for a long time and you’re ready for a change? If you’re thinking about selling your house, you have a lot to consider. Will you move to a different state or stay nearby? Is it time to downsize or do you want more space to accommodate your loved ones? But maybe the biggest consideration boils down to this – will you buy your next home or choose to rent instead? That decision ultimately depends on your current situation and your future plans. Here are two important factors to help you decide what’s right for you. Expect Rents to Keep Going Up! The graph below uses data from the Census to show how rents have been climbing steadily since 1988: Rents have been going up consistently over the long run. If you choose to rent, there’s a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

When you buy a home with a fixed-rate mortgage, it helps stabilize your monthly housing payment. This allows you to lock in your monthly payment for the duration of your home loan. That keeps your payments steady and predictable for the long haul. Freddie Mac sums it up like this: “. . . homeowners with fixed-rate loans will see little to no change to their monthly housing cost over the life of their loan. You can be confident in knowing that your mortgage payments won’t change much in the long term, even when life’s other costs do.” Owning Your Home Comes with Unique Benefits According to AARP, buying your next home is a better long-term strategy than renting: “Though each option has pros and cons, buying provides more pros, with a broader range of benefits.” To help you choose what you’ll do after you sell, here are just a few of the benefits:

If you're a baby boomer who’s wondering whether you should buy or rent your next home, let’s connect. With rents going up and homeownership providing so many benefits, it may make sense to consider buying your next home. Bottom line: CALL NANCY! Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore.

Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of Realtors (NAR), says: “As we see the transition of the large Baby Boomer generation age into retirement, it will be interesting to see if they move in with their Millennial and Gen Z children or if they stay put in their own homes.” Lautz lists two options: move into a multigenerational home with loved ones, or stay in your current house. Multigenerational living is rising in popularity, but it isn’t an option for everyone. And staying put may fit fewer and fewer of your needs. There’s a third option though, and for some, it’s the best one: downsizing. When you sell your house and purchase a smaller one, it’s known as downsizing. Sometimes smaller homes are more suited to your changing needs, and moving means you can also land in your ideal location. In addition to the personal benefits, downsizing might be more cost effective, too. The New York Times (NYT) shares: “Many downsizers expect to improve their retirement income stream if their new home costs less than what their old house sells for. Lower utility costs, insurance and property taxes — as well as investment returns on the proceeds — can also improve the bottom line.” Being in a strong financial position is one of the most important parts of retirement, and downsizing can make a big difference. A key part of why downsizing is still cost effective today, even when mortgage rates are higher than they were a year ago, is the record-high level of equity homeowners have. Leveraging your equity when you downsize can lower or maybe even eliminate the mortgage payment on your next home. So, not only is the upkeep of a smaller home likely more affordable, but leveraging your home equity could make a big difference too. I can work with you to help you understand how much equity you may have in your current home and what options it can provide for your next move. Bottom Line If you’re a homeowner getting ready for retirement, part of that transition likely includes deciding where you’ll live. Let’s connect so you can understand your options and explore your downsizing opportunities. My resources are national, but I hope you'll come for a visit to see why THE HAMMOCK COAST IS PARADISE! 7/13/2023 0 Comments HOUSE NOT SELLING? CONTACT ME!When it comes to selling your house, you want three things: to sell it for the most money you can, to do it in a certain amount of time, and to do all of that with the fewest hassles. And, while the current housing market is generally favorable to sellers due to today’s limited housing supply, there are still factors that can cause delays or even prevent a house from selling. If you're having trouble getting your house to sell in today's sellers’ market, here are a few things to think about. Limited Access – If You Can’t Show It, You Can’t Sell It. One of the biggest mistakes you can make as a seller is limiting the days and times when buyers can view your home. In any market, if you want to maximize the sale of your house, you can’t limit potential buyers’ ability to view it. Remember, minimal access equals minimal exposure. In some cases, some of the most motivated buyers may come from outside of your local area. Because they’re traveling, they might not have the luxury to adjust their schedules when faced with limited options to tour your house, so make it available as much as possible. Priced Too High – Price It To Sell, Not To Sit. Pricing is a critical factor that can significantly impact your home sale. While it's tempting to push the price higher to try to maximize your profit, overpricing can deter potential buyers and lead to your home sitting on the market longer. Not to mention, buyers today have access to a number of tools and resources to view available homes in your area. If your house is priced unreasonably high compared to similar homes, it may drive potential buyers away. Listen to the feedback your agent is getting at open houses and showings. If the feedback is consistent, it may be time to re-evaluate and potentially lower the price. Not Freshened Up Before Listing – If It Looks Good, It will make a Good Impression. When selling your house, the old saying “you never get a second chance to make a first impression” matters. Putting in the work on the exterior of your home is just as important as what you stage inside. Freshen up your landscaping to improve your home’s curb appeal so you can make an impact upfront. As an article from Investopedia says: “Curb-appeal projects make the property look good as soon as prospective buyers arrive. While these projects may not add a considerable amount of monetary value, they will help your home sell faster—and you can do a lot of the work yourself to save money and time.” Working on your curb appeal counts! But don’t let that motivation stop at the front door. By removing personal items and reducing clutter inside, you give buyers more freedom to picture themselves in the home. Additionally, a new coat of paint or cleaning the floors can go a long way to freshening up a room.

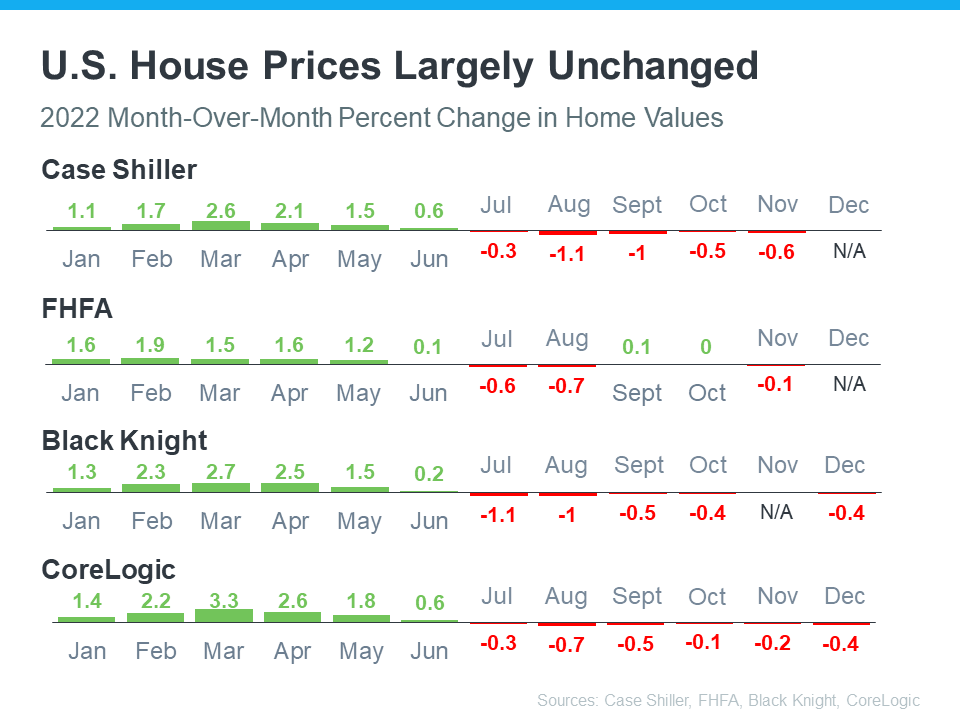

If your house isn’t getting the attention you feel it deserves and isn’t selling in the timeframe you wanted, contact me. You may need to revisit or change your approach. But, it’s like the lottery. You cannot win unless you play. I can’t help unless you reach out! Home Photo Credit: Binyamin Mellish 4/27/2023 0 Comments SPRING UPDATE!The recent changes in home prices are top of mind for many as the housing market begins gearing up for spring. It can be hard to navigate misleading headlines and confusing data, so here’s what you should know about today’s home prices. Local price trends still vary by market. Looking at national data, Nataliya Polkovnichenko, Ph.D., Supervisory Economist at the Federal Housing Finance Agency (FHFA), explains: “U.S. house prices were largely unchanged in the last four months and remained near the peak levels reached over the summer of 2022. While higher mortgage rates have suppressed demand, low inventories of homes for sale have helped maintain relatively flat house prices.” Month-over-month home price changes can be seen in the chart below. The data also shows that price depreciation peaked around August. Since then, any depreciation has been even milder. In other words, today’s home prices aren’t in a freefall. What Does This Mean for You?

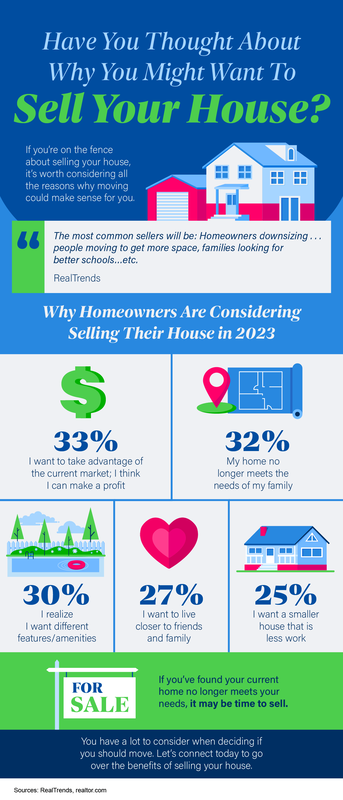

If you currently own your house, you may be concerned about even the smallest decline in prices. Keep in mind how much home values grew over the last few years. Compared to that growth, any declines we’re seeing nationally are likely to be minimal. Selma Hepp, Chief Economist at CoreLogic, shares: “. . . while prices continued to fall from November, the rate of decline was lower than that seen in the summer and still adds up to only a 3% cumulative drop in prices since last spring’s peak.” It’s also important to remember that every local market is different. Call or message me for updates in your specific area. Owning a home means having a place that is solely your own and provides the space, features, and location you and your loved ones need. But, what happens when your needs change? If this hits home for you, it may be time to make a move. According to the latest Home Buyers and Sellers Generational Trends Report from the National Association of Realtors (NAR), the average person has lived in their current house for ten years. If you have been in your home for a while, think about how much in your life has changed since you moved in. Even if you thought it would be your forever home when you bought it, it does not have to be. Work with a local real estate agent to explore all your options in today’s market before settling for your current home. That’s actually what a lot of homeowners are doing right now. A recent survey from Realtor.com finds that, of people who are considering selling in 2023, one in three are thinking about moving because their home no longer meets their needs. According to the same report from NAR, that’s consistent with this year’s top reasons for selling, which include:

If things in your life have changed, it may be time to make a move. And there’s good news: it’s still a great time to sell.

Here’s why: We are in a strong sellers’ market. That means homes listed at market value and in good condition are getting attention from buyers and selling quickly. Lean on me and let's talk about getting your house ready to sell. Your equity can power your next move. There is a good chance you have a significant amount of equity right now thanks to record levels of price appreciation in recent years. When you sell, you can use that equity to help afford your next home. In fact, NAR’s report from above shows 38% of recent buyers used the money from the sale of their previous home to cover the down payment on their next one. Bottom Line Work with me to learn how much equity you have and what you can do with it in today’s housing market. If your home no longer meets your needs, consider selling it so you can find your dream home. Let’s connect so you can learn about your options. 3/21/2023 0 Comments the power of pre-approval!If you are buying a home, today’s housing market can feel like a challenge. With so few homes on the market right now, plus higher mortgage rates, it’s essential to have a firm grasp on your home buying budget. You will also need a sense of determination to find the right house and act quickly when you go to put in an offer. One thing you can do to help you prepare is to get pre-approved.

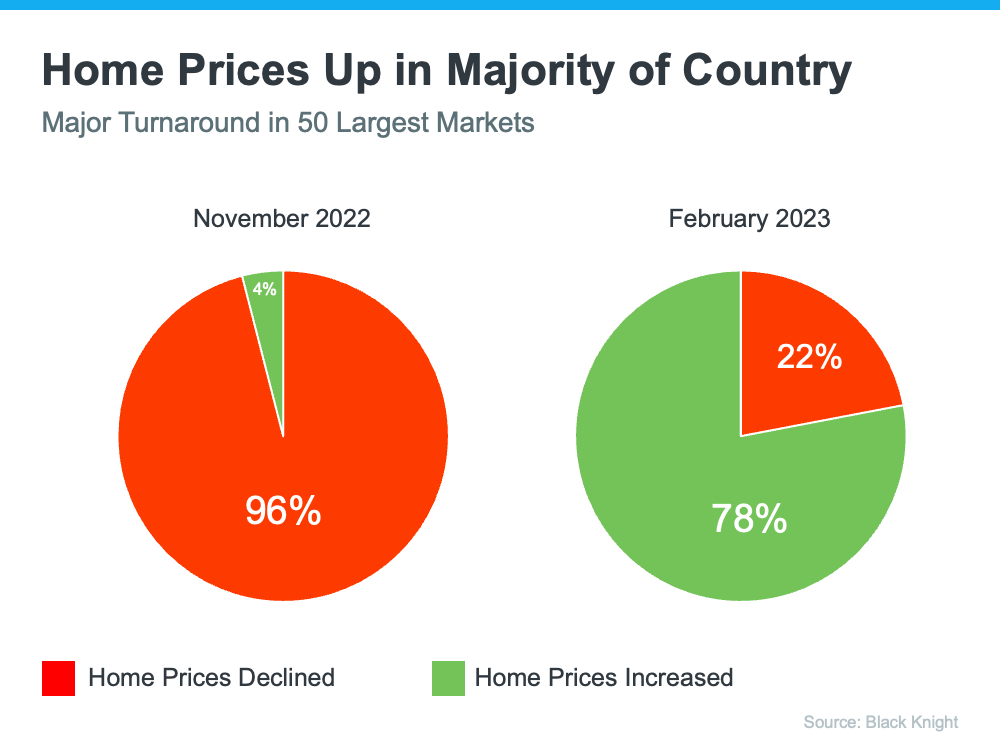

To understand why it is such an important step, you need to know what pre-approval is. As part of the process, a lender looks at your finances to determine what they would be willing to loan you. From there, your lender will give you a pre-approval letter to help you understand how much money you can borrow. Freddie Mac explains it like this: “A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.” Pre-approval gives you critical information about the home buying process that will help you understand how much you may be able to borrow so you have a stronger grasp of your options. With higher mortgage rates impacting affordability for many buyers today, a solid understanding of your numbers is even more important. Pre-Approval Helps Show You’re a Serious Buyer That is not the only thing pre-approval can do. Another added benefit is it can help a seller feel more confident in your offer because it shows you are serious about buying their house. With sellers seeing a slight increase in the number of offers again this spring, making a strong offer when you find the perfect house is key. As a recent article from the Wall Street Journal (WSJ) says: “If you plan to use a mortgage for your home purchase, preapproval should be among the first steps in your search process. Not only can getting preapproved help you zero in on the right price range, but it can give you a leg up on other buyers, too.” My Bottom Line: Getting pre-approved is an important first step when you are buying a home. It lets you know what you can borrow for your loan and shows sellers you are serious. As the housing market continues to change, you may be wondering where it will go from here. One factor you are probably thinking about is home prices, which have come down a bit since they peaked last June. You’ve likely heard something in the news or on social media about a price crash on the horizon. As a result, you may be holding off on buying a home until prices drop significantly. That’s not the best strategy. A recent survey from Zonda shows 53% of millennials are still renting right now because they’re waiting for home prices to come down. Here’s the thing: the most recent data shows that home prices appear to have bottomed out and are now on the rise again. Selma Hepp, Chief Economist at CoreLogic, reports: “U.S. home prices rose by 0.8% in February . . . indicating that prices in most markets have already bottomed out.” And the latest data from Black Knight shows the same shift. The graph below compares home price trends in November to those in February: So, should you keep waiting to buy a home until prices come down?

If you factor in what the experts are saying, you probably should not. The data shows prices are increasing in much of the country, not decreasing. The latest data from the Home Price Expectation Survey indicates that experts project home prices will rise steadily and return to more normal levels of appreciation after 2023. My Bottom Line: Let’s have a conversation. That’s the best way to understand what home values are doing in the Myrtle Beach Market. If you are waiting to buy a home until prices come down, you may want to reconsider. Connect with me to make sure you understand what’s happening in our local housing market. |

Location1232-B Farrow Parkway

Myrtle Beach, SC 29577 |

Client Kuddos:

|

RSS Feed

RSS Feed