|

“Nancy is an amazing agent!. She went “above and beyond” to help us find the perfect home. She took the time to show us many houses. She was patient while we decided. She worked with and for us every step of the way. I recommend her to anyone looking to buy here. We moved from Connecticut and she educated us on the area so we were comfortable moving somewhere we had never been before.” Duncan Brown - Murrells Inlet, SC |

Nancy Aborn Wuennemann |

|

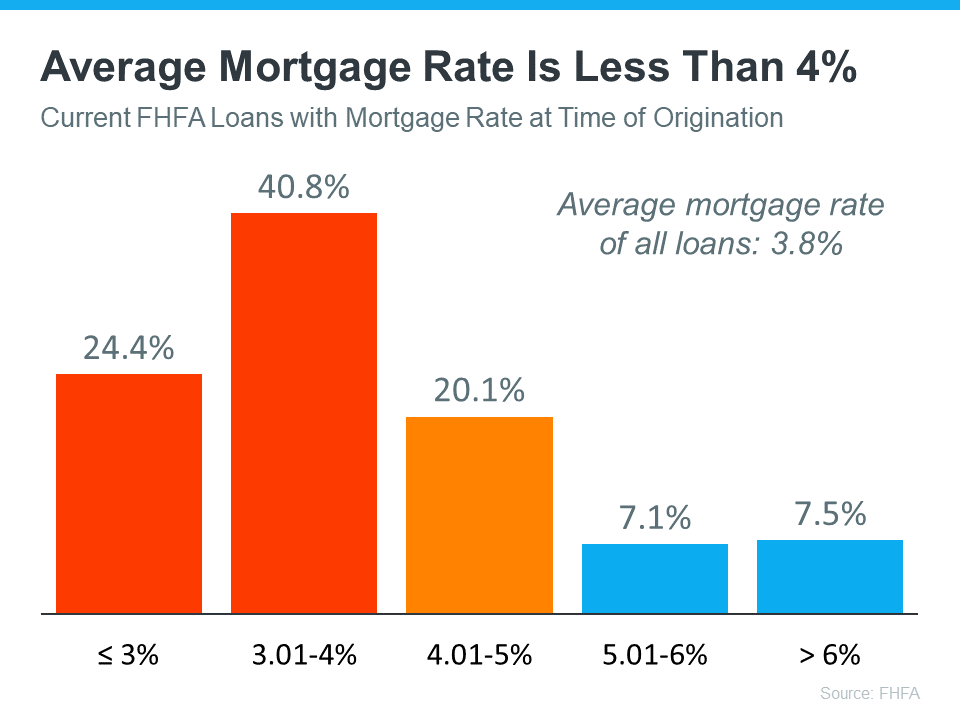

The biggest challenge the housing market’s facing is how few homes there are for sale. Mark Fleming, Chief Economist at First American, explains the root causes of today’s low supply: “Two dynamics are keeping the existing-home inventory historically low – rate-locked existing homeowners and the fear of not finding something to buy.” Let’s break down these two big issues in today’s housing market. Rate-Locked Homeowners According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below): Today, the typical mortgage rate offered to buyers is over 6%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as being rate locked.

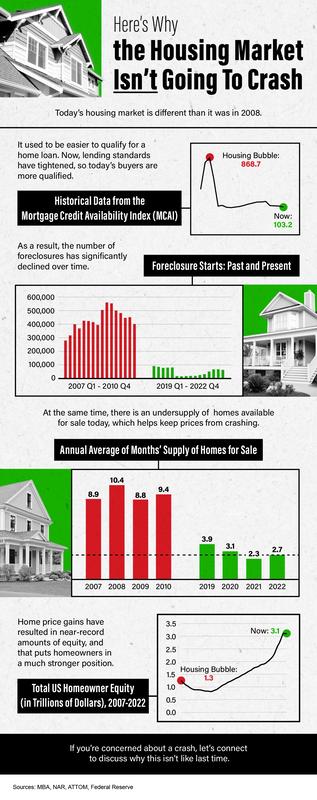

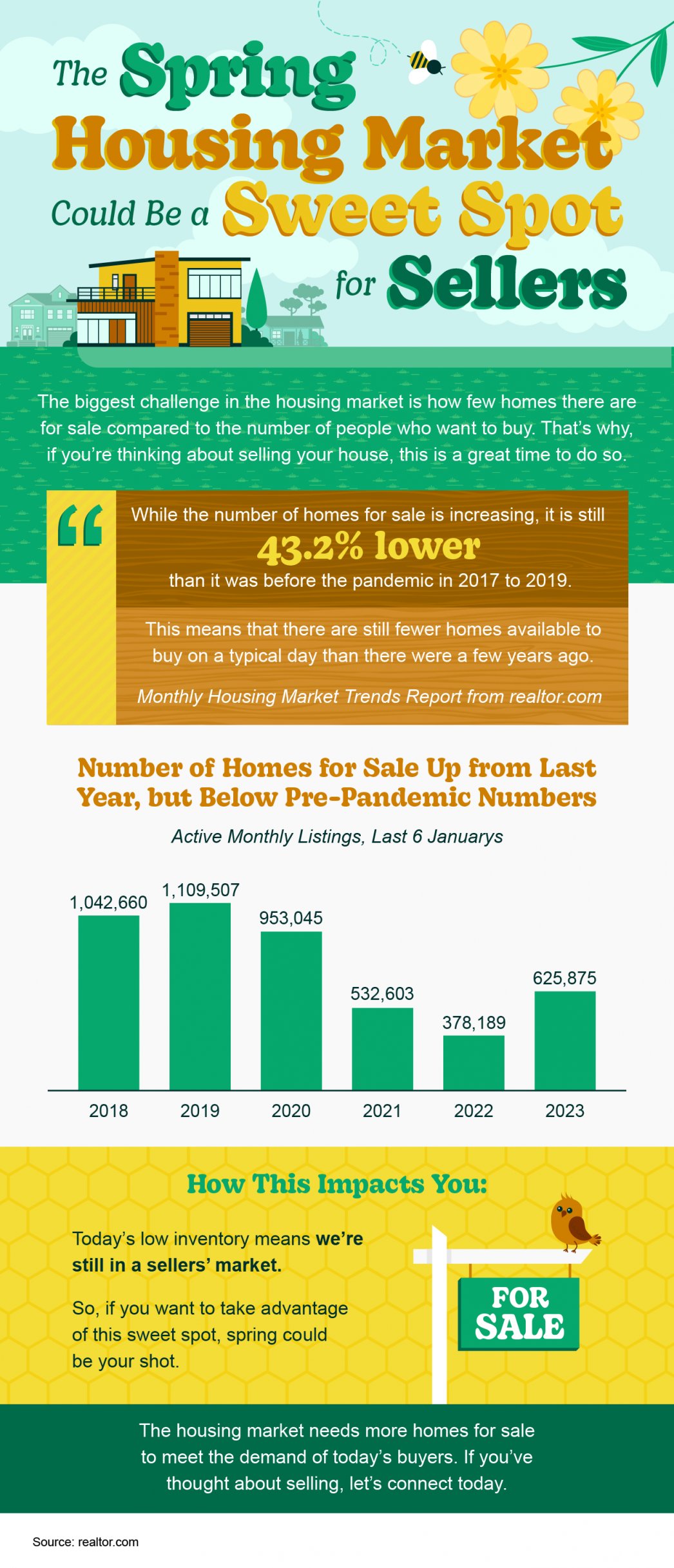

When so many homeowners are rate locked and reluctant to sell, it’s a challenge for a housing market that needs more inventory. However, experts project mortgage rates will gradually fall this year, and that could mean more people will be willing to move as that happens. The Fear of Not Finding Something To Buy The other factor holding back potential sellers is the fear of not finding another home to buy if they move. Worrying about where they will go has left many on the sidelines as they wait for more homes to come to the market. That is why, if you are on the fence about selling, it is important to consider all your options. That includes newly built homes, especially right now when builders are offering concessions like mortgage rate “buydowns.” What Does This Mean for You? These two issues are keeping the supply of homes for sale lower than pre-pandemic levels. But, if you want to sell your house, today’s market is a sweet spot that can work to your advantage. I can help you explore your options. This could include leveraging your current home equity. According to ATTOM: “. . . 48 percent of mortgaged residential properties in the United States were considered equity-rich in the fourth quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than 50 percent of their estimated market values.” This could make a major difference when you move. Work with me to learn how putting your equity to work can keep the cost of your next home down. 2/18/2023 0 Comments SPRING MARKET IS FOR SELLERSThe biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

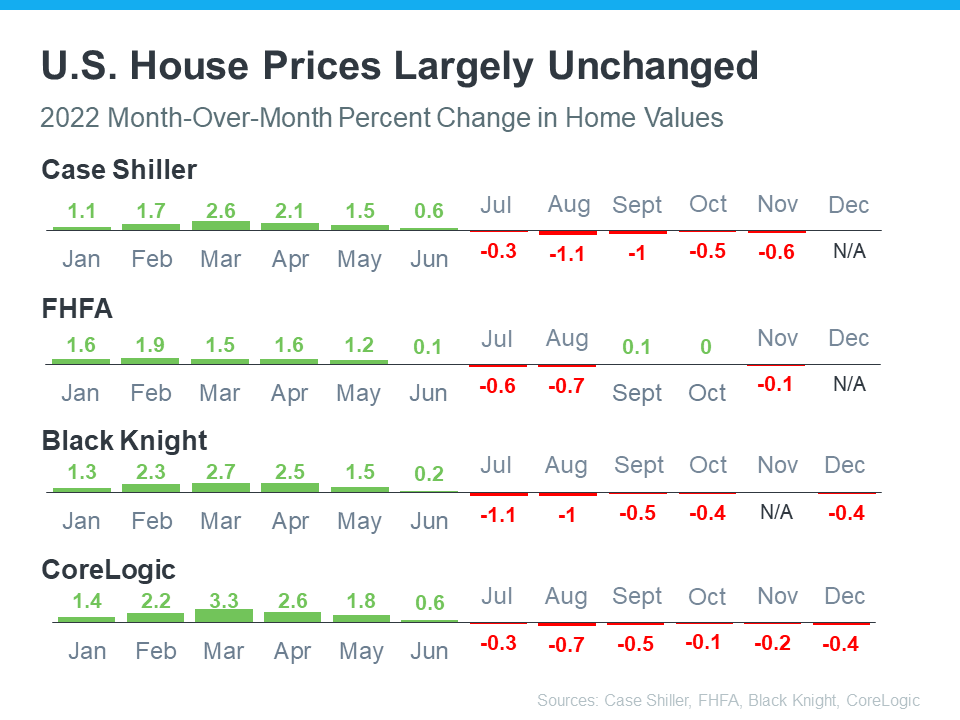

The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we are still in a sellers’ market. The housing market needs more homes for sale to meet the demand of today’s buyers. If you have thought about selling, let’s connect today. 2/10/2023 0 Comments what is going on with home prices?Recent changes in home prices are top of mind for many as the housing market begins gearing up for spring. It can be hard to navigate misleading headlines and confusing data, so here is what you should know about today’s home prices.

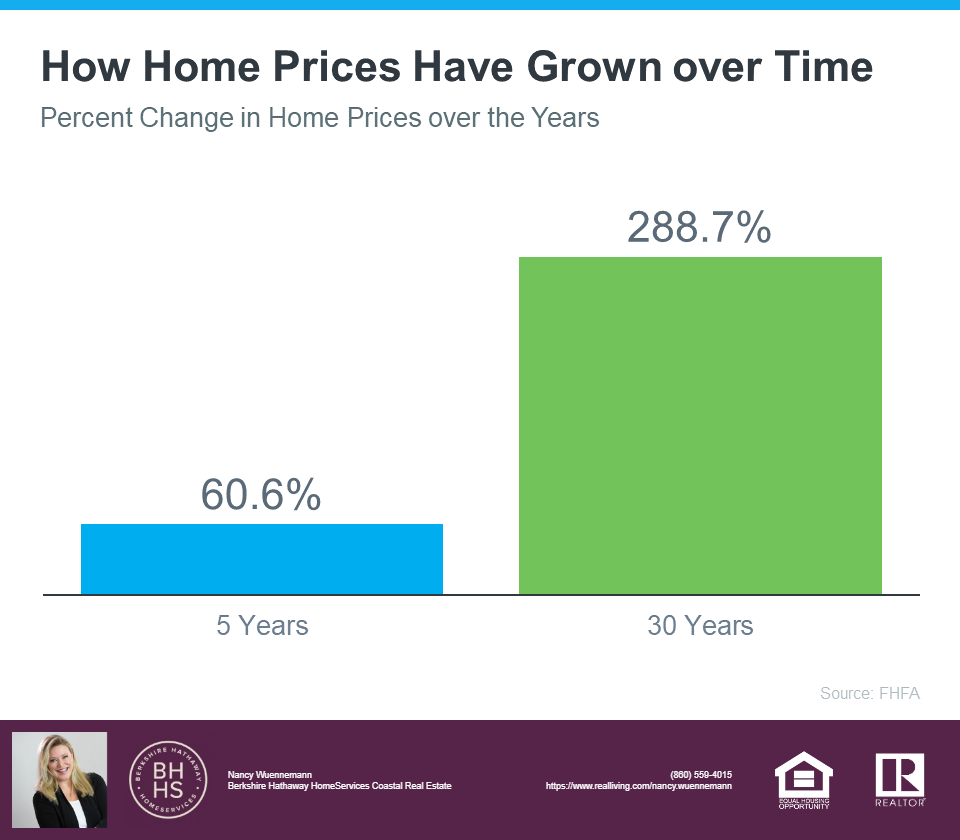

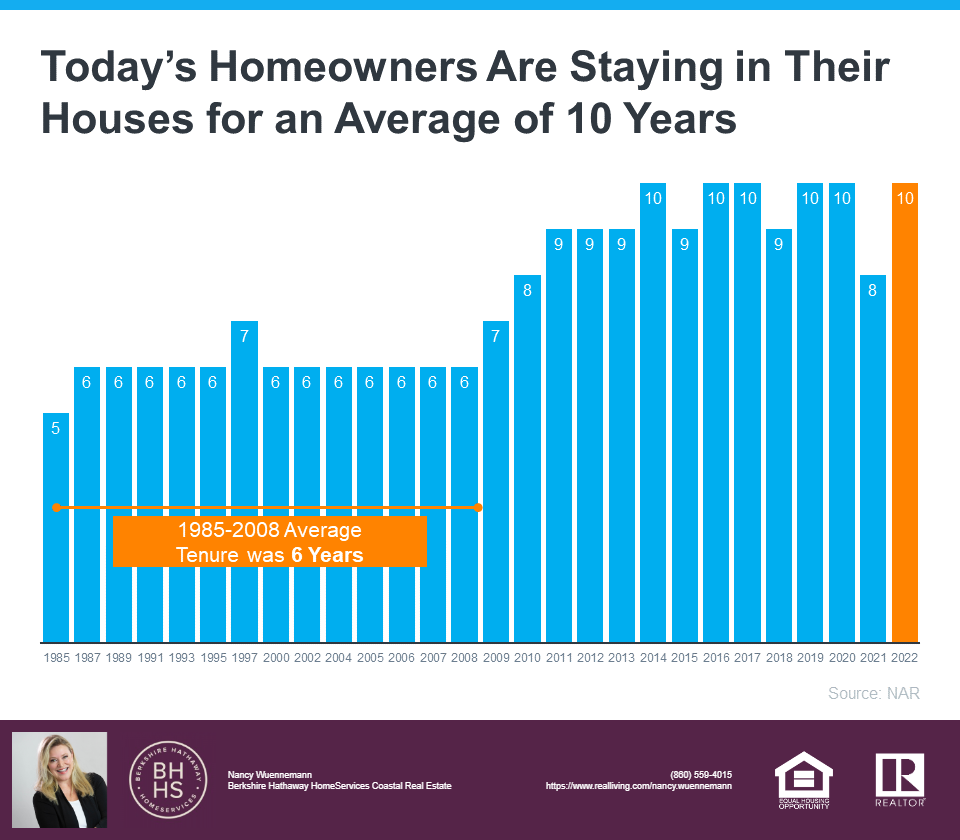

Local price trends still vary by market. But looking at national data, Nataliya Polkovnichenko, Ph.D., Supervisory Economist at the Federal Housing Finance Agency (FHFA), explains: “U.S. house prices were largely unchanged in the last four months and remained near the peak levels reached over the summer of 2022. While higher mortgage rates have suppressed demand, low inventories of homes for sale have helped maintain relatively flat house prices.” Month-over-month home price changes can be seen in the chart. The data also shows that price depreciation peaked around August. Since then, any depreciation has been even milder. In other words, today’s home prices are not in a freefall. What Does This Mean for You? If you currently own your house, you may be concerned about even the smallest decline in prices. But keep in mind how much home values grew over the last few years. Compared to that growth, any declines we are seeing nationally are likely to be minimal. Selma Hepp, Chief Economist at CoreLogic, shares: “. . . while prices continued to fall from November, the rate of decline was lower than that seen in the summer and still adds up to only a 3% cumulative drop in prices since last spring’s peak.” If you are planning to make a move to the Myrtle Beach area in 2023, let's talk about market trends. If you are thinking about retirement or have already retired this year, you may be planning your next steps. One of your goals could be selling your house and finding a home that more closely fits your needs. Fortunately, you may be in a better position to make a move than you realize. Here are a few things to think about when making that decision. Consider How Long You’ve Been in Your Home! From 1985 to 2008, the average length of time homeowners typically stayed in their homes was only six years. According to the National Association of Realtors (NAR), that number is rising today, meaning many homeowners are living in their houses even longer. When you live in a home for a significant period of time, it is natural for you to experience a number of changes in your life while you are in that house. As those life changes and milestones happen, your needs may change. If your current home no longer meets your needs, you may have better options waiting for you. Consider the Equity You’ve Gained Additionally, if you have been in your home for more than a few years, you have likely built up significant equity that can fuel your next move. That is because the longer you have been in your home, the more likely it has grown in value due to home price appreciation. Data from the Federal Housing Finance Agency (FHFA) illustrates that point (see graph below): While home price growth varies by state and local area, the national average shows the typical homeowner who has been in their house for five years saw it increase in value by over 50%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

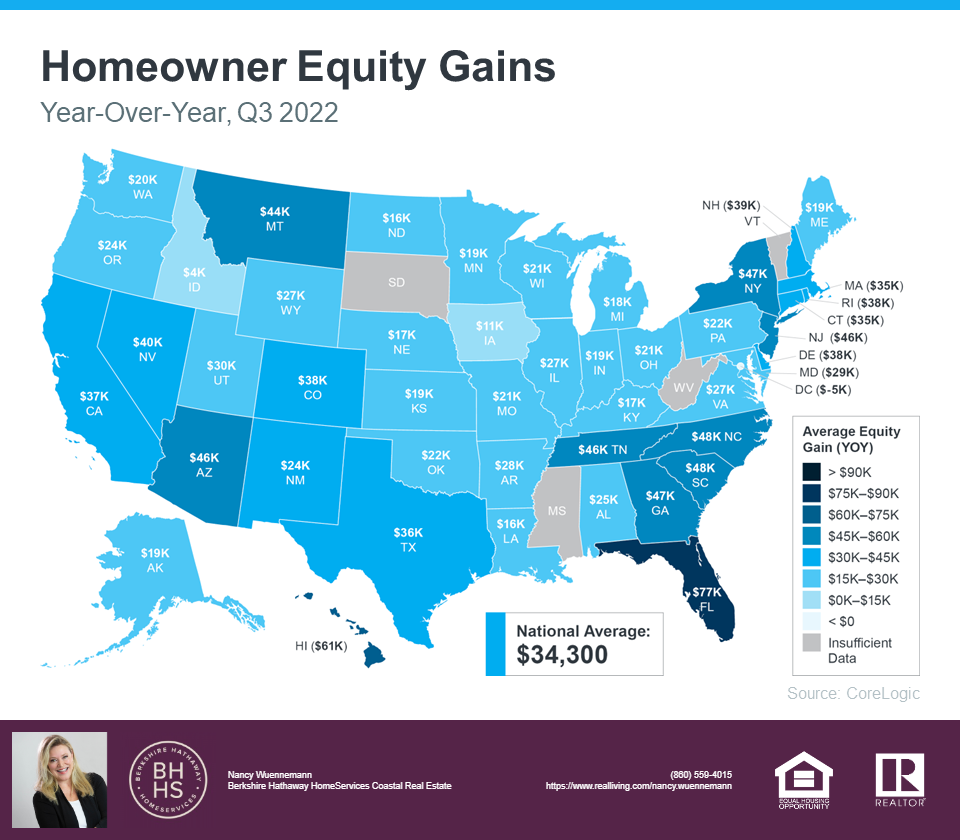

Consider Your Retirement Goals Whether you are looking to downsize, relocate to a dream destination, or move so you live closer to loved ones, that equity can help you achieve your homeownership goals. NAR shares that for recent home sellers, the primary reason to move was to be closer to loved ones. Retirement also played a large role for those moving greater distances. Whatever your home goals are, I can work with you to find the best option. I can help you sell your current house and guide you as you buy the home that is right for you and your lifestyle today. Retirement can bring about major changes in your life, including what you need from your home. Let’s connect to explore your opportunities in the Myrtle Beach Market. 1/27/2023 0 Comments it's all about the equity!If you are a homeowner, your net worth got a BIG boost over the past few years thanks to rapidly rising home prices. Here is how it happened and what it means for you, even as the market moderates. Equity is the current value of your home minus what you owe on the loan. Because there was a significant imbalance between the number of homes available for sale and the number of buyers looking to make a purchase over the past few years, home prices appreciated substantially. While home price appreciation has moderated this year, and even depreciated slightly in some overheated markets, that does not mean you have lost all the equity you gained during the pandemic frenzy. To prove you still have equity you can use, the latest Homeowner Equity Insights from CoreLogic finds the average homeowner equity has actually grown by $34,300 over the past 12 months. That is right, despite the headlines, the average homeowner still gained positive equity over the last year in just about every market. While the gains are not as dramatic as they were in the previous quarter due to home price moderation, they are still significant. In addition, if you have been in your home for longer than a year, chances are you have even more equity than you realize. While that is the national number, if you want to know what happened over the past year in your area, look at the map below from CoreLogic: Why This Is So Important Right Now

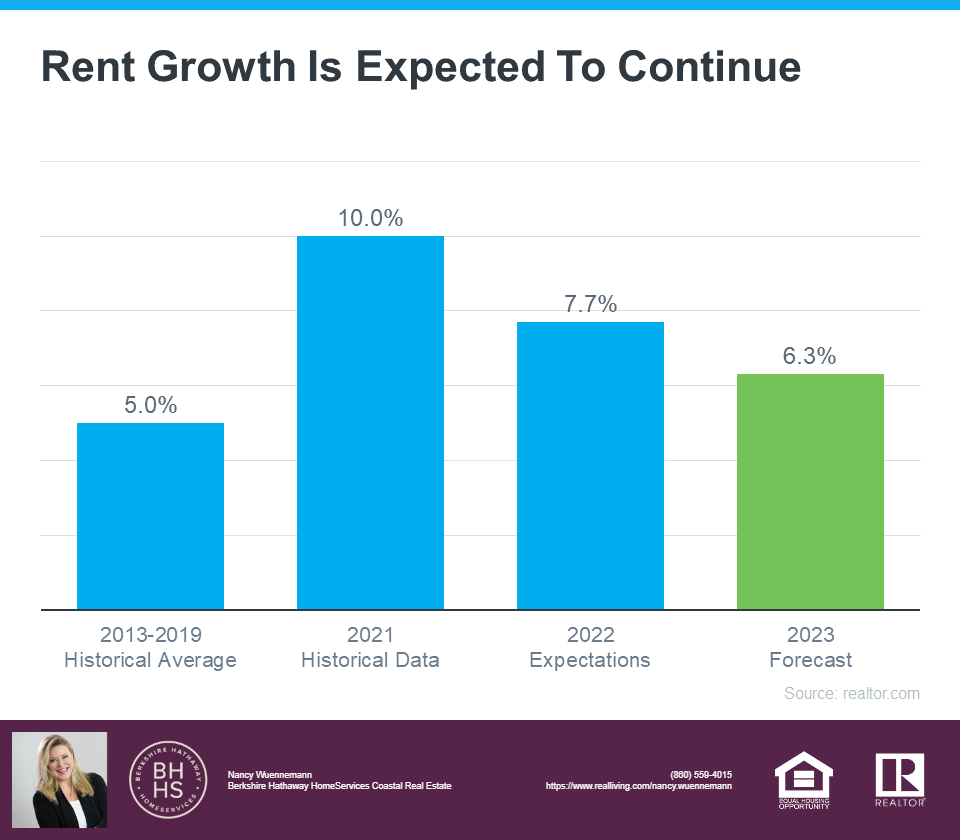

While equity helps increase your overall net worth, it can also help you achieve other goals, like buying your next home. When you sell your current house, the equity you have built up comes back to you in the sale, and it may be just what you need to cover a large portion – if not all – of the down payment on your next home. If you have been holding off on selling because you were not sure what the headlines meant for your bottom line, rest assured you have still gained equity in recent years, and it can help fuel your move. Planning to make a move in 2023? Now you have proof that the equity you have gained over time can make a big impact. To find out just how much equity you have in your current home and how you can use it to fuel your next purchase, shoot me a text, give me a call… let’s connect. The 2023 Housing Forecast from realtor.com expects rents will keep climbing. (see graph below): That forecast projects rents will increase by 6.3% in the year ahead (shown in green above). When compared to the blue bars in the graph, it is clear that the 2023 projection does not call for an increase as drastic as the ones renters have seen over the past two years, but it is still above the historical average for rent hikes between 2013 and 2019.

That means, if you are planning to rent again this year and you have not yet renewed your lease, you may pay more when you do. These rising costs may make you reconsider what other alternatives you have. If you are looking for more stability, it could be time to prioritize homeownership. One of the many benefits of owning your own home is it provides a stable monthly cost that you can lock in for the duration of your loan. As Freddie Mac says: “Monthly rent payments may increase over time, but a fixed-rate mortgage will ensure that you’re paying the same amount each month. With a fixed-rate mortgage, your interest rate is locked in for the life of loan. Steady payments allow you to budget wisely and make plans for the future.” If you are planning to make a move this year, locking in your monthly housing costs for the duration of your loan can be a major benefit. You will avoid wondering if you will need to adjust your budget to account for annual increases like those that you would if you left your housing payment up to your landlord and their renewal cycle. Homeowners also enjoy the added benefit of home equity, which has grown substantially. In fact, the latest Homeowner Equity Insight report from CoreLogic shows the average homeowner gained $34,300 in equity over the last 12 months. As a renter, your rent payment only covers the cost of your dwelling. When you pay your mortgage on a house, you grow your wealth through the forced savings that is your home equity. If you’re thinking of renting this year, it’s important to keep in mind the true costs you’ll face. Let’s chat to see how you can begin your journey to homeownership today. 1/16/2023 0 Comments HOME SELLING BEST PRACTICESA new year brings with it the opportunity for new experiences. If that resonates with you because you are considering making a move, you are likely juggling a mix of excitement over your next home and a sense of attachment to your current one. A great way to ease some of those emotions and ensure you are feeling confident in your decision is to keep these three best practices in mind. 1. Price Your Home Right The housing market shifted in 2022 as mortgage rates rose, buyer demand eased, and the number of homes for sale grew. As a seller, you will want to recognize things are different now and price your house appropriately based on where the market is today. Greg McBride, Chief Financial Analyst at Bankrate, explains: “Price your home realistically. This isn’t the housing market of April or May, so buyer traffic will be substantially slower, but appropriately priced homes are still selling quickly.” If you price your house too high, you run the risk of deterring buyers. And if you go too low, you’re leaving money on the table. An experienced real estate agent can help determine what your ideal asking price should be. 2. Keep Your Emotions in Check Today, homeowners are living in their houses longer. According to the National Association of Realtors (NAR), since 1985, the average time a homeowner has owned their home has increased from 5 to 10 years (see graph below): This is several years longer than what used to be the historical norm. The side effect, however, is when you stay in one place for so long; you may be even more emotionally attached to your space. If it is the first home you bought or the house where your loved ones grew up, it very likely means something extra special to you. Every room has memories, and it is hard to detach from the sentimental value.

For some homeowners, that makes it even harder to negotiate and separate the emotional value of the house from fair market price. I can assist you with negotiations along the way. 3. Stage Your Home Properly While you may love your decor and how you have customized your home over the years, not all buyers will feel the same way about your design. That is why it is so important to make sure you focus on your home’s first impression so it appeals to as many buyers as possible. As NAR says: “Staging is the art of preparing a home to appeal to the greatest number of potential buyers in your market. The right arrangements can move you into a higher price-point and help buyers fall in love the moment they walk through the door.” Buyers want to envision themselves in the space so it truly feels like it could be their own. They need to see themselves inside with their furniture and keepsakes – not your pictures and decorations. I can help you with tips to get your house ready to sell. The bottom line is this: If you are considering selling your house, let’s connect so you have the help you need to navigate through the process while prioritizing these best practices. If you are thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market this year. In 2022, the market underwent a major shift as economic uncertainty and higher mortgage rates reduced buyer demand, slowed the pace of home sales, and moderated home prices. What about 2023?

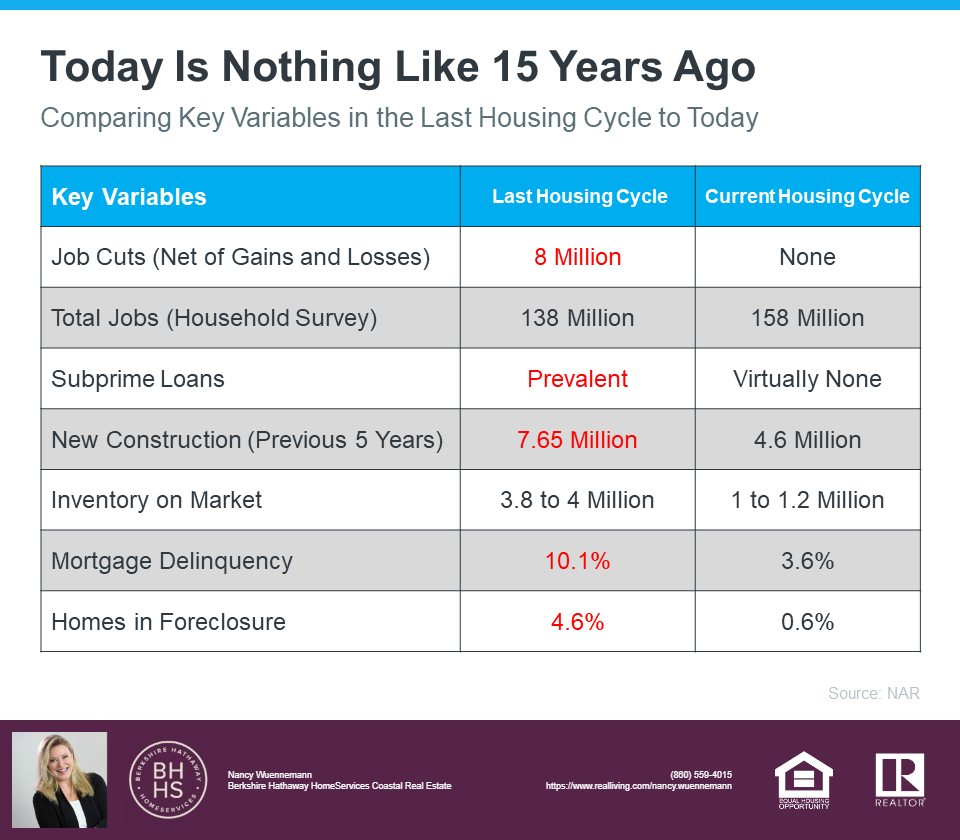

An article from HousingWire offers this perspective: “The red-hot housing market of the past 2 ½ years was characterized by sub-three percent mortgage rates, fast-paced bidding wars and record-low inventory. More recently, market conditions have done an about-face. . . . Now is the opportunity for everyone to become re-educated about what a ‘typical’ housing market looks like.” This year, experts agree we may see the return of greater stability and predictability in the housing market if inflation continues to ease and mortgage rates stabilize. Here is what they have to say. The 2023 forecast from the National Association of Realtors (NAR) says: “While 2022 may be remembered as a year of housing volatility, 2023 likely will become a year of long-lost normalcy returning to the market, . . . mortgage rates are expected to stabilize while home sales and prices moderate after recent highs, . . .” Danielle Hale, Chief Economist at realtor.com, adds: “. . . Buyers will not face the extreme competition that was commonplace over the past few years.” Lawrence Yun, Chief Economist at NAR, explains home prices will vary by local area, but will net neutral nationwide as the market continues to adjust: “After a big boom over the past two years, there will essentially be no change nationally . . . Half of the country may experience small price gains, while the other half may see slight price declines.” Mark Fleming, Chief Economist at First American, says: “The housing market, once adjusted to the new normal of higher mortgage rates, will benefit from continued strong demographic-driven demand relative to an overall, long-run shortage of supply.” If you’re looking to buy or sell a home this year, the best way to ensure you’re up to date on the latest market insights is to partner with me. Myrtle Beach has some great values. 12/29/2022 0 Comments we're not going backwards!There’s no doubt today’s housing market is very different than the frenzied one from the past couple of years. In the second half of 2022, there was a dramatic shift in real estate, and it caused many people to make comparisons to the 2008 housing crisis. While there may be a few similarities, when looking at key variables now compared to the last housing cycle, there are significant differences. In the latest Real Estate Forecast Summit, Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), drew the comparisons below between today’s housing market and the previous cycle: Looking at the facts, it is clear: today is VERY different than the housing market of 15 years ago.

There is Opportunity in Real Estate Today And in today’s market, with inventory rising and less competition from other buyers, there’s opportunity right now. According to David Stevens, former Assistant Secretary of Housing: “So be advised…this may be the one and only window for the next few years to get into a buyer’s market. And remember…as the Federal Reserve data shows…home prices only go up and always recover from recessions no matter how mild or severe. Long term homeowners should view this market…right now…as a unique buying opportunity.” Today’s housing market is nothing like the real estate market 15 years ago. If you’re a buyer right now, this may be the chance you’ve been waiting for. |

Location1232-B Farrow Parkway

Myrtle Beach, SC 29577 |

Client Kuddos:

|

RSS Feed

RSS Feed