|

“Nancy is an amazing agent!. She went “above and beyond” to help us find the perfect home. She took the time to show us many houses. She was patient while we decided. She worked with and for us every step of the way. I recommend her to anyone looking to buy here. We moved from Connecticut and she educated us on the area so we were comfortable moving somewhere we had never been before.” Duncan Brown - Murrells Inlet, SC |

Nancy Aborn Wuennemann |

|

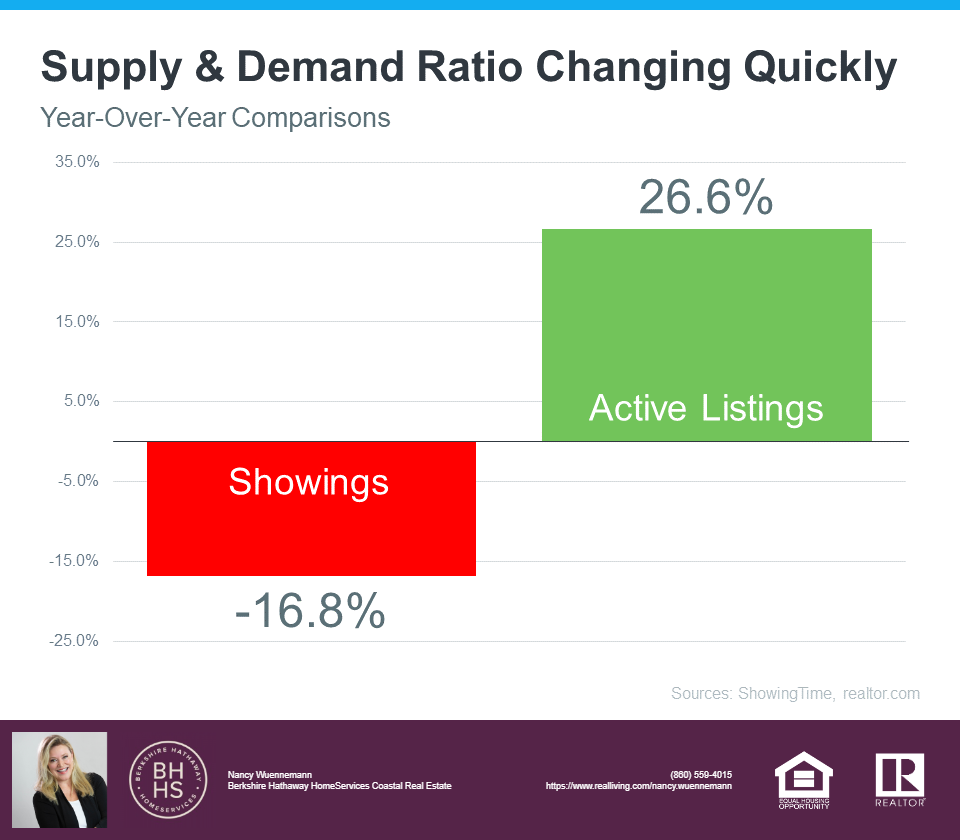

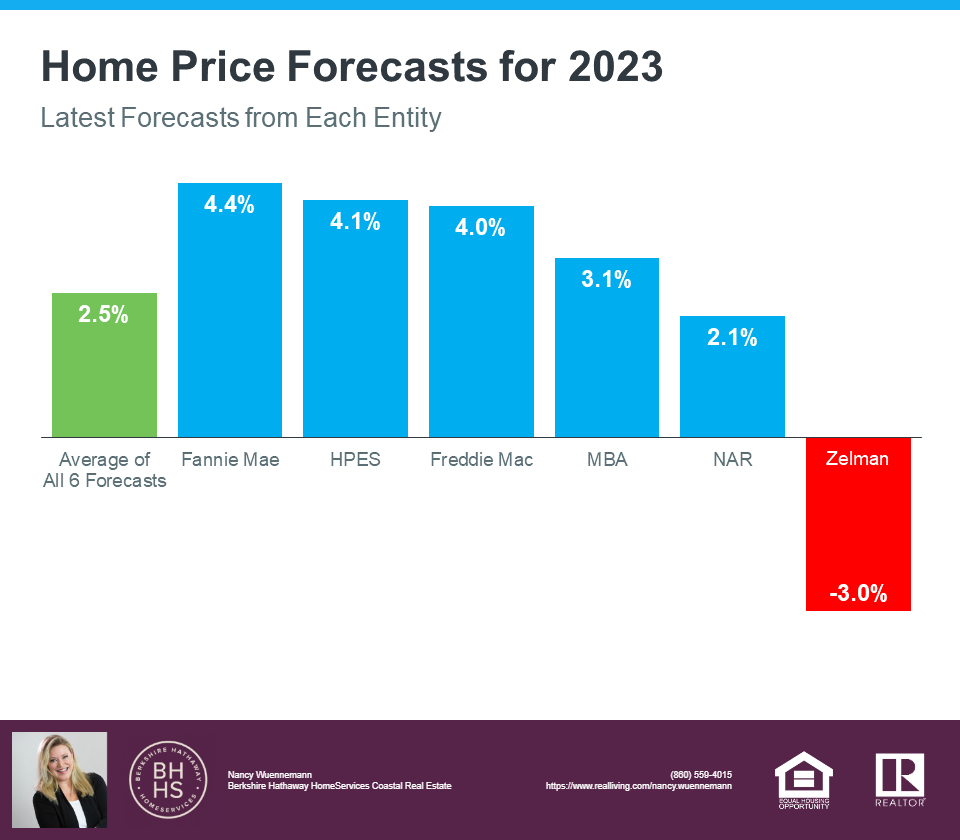

The talk of a housing bubble in the coming year seems to be at a fever pitch as rising mortgage rates continue to slow down an overheated real estate market. Over the past two years, home prices have appreciated at an unsustainable pace causing many to ask: are things just slowing down, or is a crash coming? To answer this question, there are two things we want to understand. The first is the reality of the shift in today’s housing market. And the second is what experts are saying about home prices in the coming year. The reality is we’re seeing an inflection point in housing supply and demand. According to realtor.com, active listings have increased more than 26% over last year, while showings from the latest ShowingTime Showing Index have decreased almost 17% from last year (see graph below). This is an inflection point for housing because, over the past two years, we’ve seen a massive amount of demand (showings) and not enough homes available for sale for the number of people that wanted to buy. That caused the market frenzy. Today, supply and demand look very different, and the market is slowing down from the pace we’ve seen. This offers proof of the sudden slowdown so many people are feeling. What Housing Experts Are Saying About Home Prices in the Coming Year Right now, most experts are forecasting home price appreciation in 2023, but at a much slower pace than the last two years. The average of the six forecasters below is for national home prices to appreciate by 2.5% in the coming year. Only one of the six is calling for home price depreciation. When we look at the shift taking place along with what experts are saying, we can conclude the national real estate market is slowing down but is not a bubble getting ready to burst. This isn’t to say that a few overheated markets won’t experience home price depreciation, but there isn’t a case to be made for a national housing bubble. The Bottom Line

The real estate market IS slowing down. What we’ve experienced in the housing market over the past two years were historic levels of demand and constrained supply. That led to homes going up in value at a record pace. While some overheated markets may experience price depreciation in the short term, according to experts, the national real estate market will appreciate in the coming year. Want to talk about specifics of the housing market in Horry and Georgetown Counties? I believe the market is going to be incredibly strong for BOTH buyers and sellers over the next 10 to 15 years. Shoot me a text. Give me a call. I would welcome the opportunity to share my insights why Myrtle Beach is a GREAT area to look at retirement, second home and investment properties.

0 Comments

Leave a Reply. |

Location1232-B Farrow Parkway

Myrtle Beach, SC 29577 |

Client Kuddos:

|

RSS Feed

RSS Feed